Capital One Sends E-mail Threats, Escalates War on Responsible Credit Users

Capital One, the financial behemoth often viewed as the dark horse in the credit card race, has been making some intriguing moves lately. On one hand, they’ve launched the Venture X, parading it as a challenger to the AmEx and Chase duopoly, and even venturing into the glamorous world of airport lounges. Yet, beneath this veneer of competition in a more prestigious arena, Capital One’s underwriting practices tell a different tale.

Most credit card issuers neatly fit into two categories: those that are all about lending and those that thrive on spending. Chase and AmEx fall solidly into the spend-focused camp, attracting users who treat their cards like glorified debit cards, and making their profits primarily on interchange, or “swipe” fees. Capital One and Discover (do they even count?), on the other hand, remain steadfastly lend-focused. Their target? Consumers who carry balances and incur interest, padding Capital One’s coffers with the fruits of compounded interest.

In fact, having an impeccable credit score may actually be a hindrance when seeking approval for Capital One’s credit card products. Tales abound of individuals boasting 800+ credit scores, effortlessly securing cards from the likes of Chase, Citi, and AmEx, only to face the unfamiliar sting of rejection from Capital One.

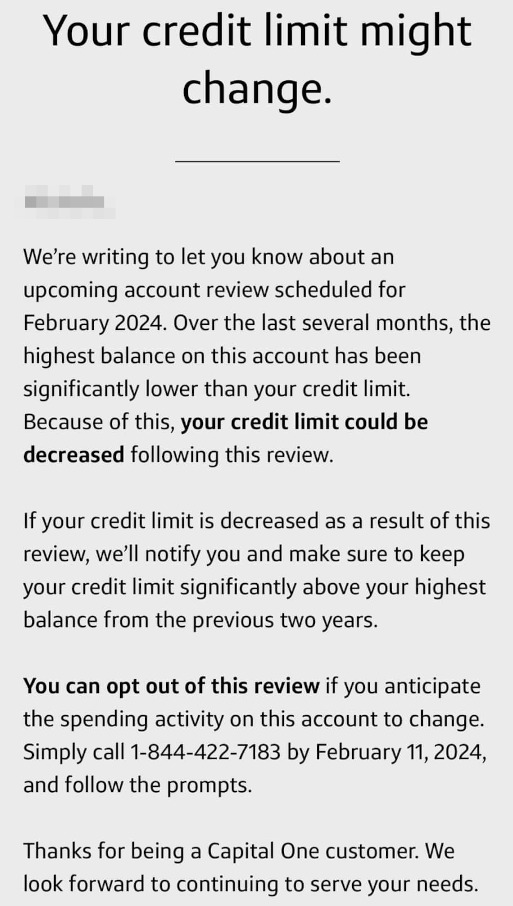

Now, it seems Capital One has escalated its war on responsible credit users. A reader shared a snapshot of an ominous email from the issuer, threatening a decrease in their credit limit. The reason? They haven’t come close enough to maxing out their cards. In the stark words of the email, “Over the last several months, the highest balance on this account has been significantly lower than your credit limit. Because of this, your credit limit could be decreased following this review.” They want you toeing the line, and if you’re not, there are consequences.

The email gives a 60-day heads-up, offering a choice: either ramp up your balance, or dial a toll-free number to plead your case. But why should you care about this? Even if you have no plans to need that large of a credit line, a decrease in your credit limit can wreak havoc on your credit score, particularly by increasing your credit utilization ratio. This is a percentage of your available credit being used; if the denominator goes down and the numerator remains constant, that percentage is going to soar, even if your spending habits don’t change.

Now, why would Capital One want to lead people down the treacherous path of poor credit decisions? The answer is glaringly simple: interest rates are soaring. While some pundits predict the end of interest rate hikes, many credit cards are still flexing jaw-dropping interest rates of 30% or more. It’s a lucrative time for banks, and Capital One wants a slice of that high-interest pie. Most of us don’t even know the interest rates on our own credit cards, because we pay them off each month before interest begins accruing. If this describes you, you’re probably not in Capital One’s target audience.

But, wouldn’t they be concerned about users defaulting? Not quite. From the bank’s perspective, it’s akin to making an investment with a jaw-dropping ~30% annual return, compounding. It’s a staggering return, and of course no investment carries that kind of return without risk. However, the banks are well aware of this, pricing it into their calculations. After all, when the potential gains are that substantial, a calculated risk becomes just another part of the game.

As interest rates soar, the issuer’s tactics appear geared towards nudging users into carrying balances, transforming their credit cards into instruments of compounded returns for the bank. While Chase and AmEx focus on a customer base with pristine credit and good money management habits, Capital One seems intent on playing by its own rules.